How to Accept Payments Online (Credit, PayPal, QR Codes+)

December 19, 2022 by Invoice Simple

How to Accept/Collect Payments Online

Having the ability to collect payments online has become an increasingly important part of doing business. The ease and convenience of paying online with a variety of methods have led to more customers buying more products and services than ever before.

Offering multiple ways to accept payments online can lead to improved payment rates. It can also reduce internal friction as customers are more likely to complete a purchase when there are a variety of payment options available.

We’ll show you how to accept credit card payments online through a variety of methods as well as provide some tips to get you started!

How Does Payment Processing Work?

The basic steps of credit card payment processing remain the same, regardless of whether payment is in person or online:

- Authorization—The bank will check to see if the credit cardholder has the necessary funds to cover the cost of the purchase. If approved, the bank will send an authorization code to the merchant.

- Capture—The funds are transferred from the cardholder’s account to the merchant’s account. Capture typically takes place within 24-48 hours after authorization.

- Settlement— The merchant’s bank deposits the funds from the approved transaction into the merchant’s account. Depending on the bank, this process can take one to five days.

What Is the Safest Way to Accept Payment Online?

Though a convenient way of doing business, accepting payments of any kind online comes with a certain amount of risk. But there are ways to minimize that risk and keep your customers’ information safe.

There are a lot of payment processors out there, but not all of them are equally reputable. Make sure you do your research and choose a processor that has a good reputation and is known for being secure. Some of the most popular and reputable processors include PayPal and Venmo.

Encryption is a process that scrambles data so that it can only be decrypted and read by authorized parties. Most payment processors use encryption by default, but it’s always good to double-check that the processor you’re using does indeed have this security measure in place.

Two-factor authentication is an extra layer of security that requires users to provide two pieces of identifying information instead of just one. For example, when you log into your PayPal account, you first enter your username and password as usual.

Then, PayPal also sends a code to your phone, which you need to enter before you can access your account. This makes it much harder for someone to hack into your account because they would need both your password and access to your phone in order to do so.

How do I set up an Online Payment System ?

Setting up an online payment system can be intimidating, but it doesn’t have to be. It’s quite simple, and online invoice payment processing software like Invoice Simple makes it even easier.

As an example, here’s how to set up Invoice Simple’s online payment system in no time:

- Create an Invoice Simple account by entering your email address and creating a password.

- Payments can be set up either from Settings or right on the invoice creation page.

- Turn on Accept Online Payment. You’ll be directed to the Invoice Simple partnership page with PayPal.

- Click Get Started. You’ll be directed to a login screen.

- Login with your existing PayPal business account or follow the instructions to create a new PayPal business account.

- Set up your automatic deposits.

Setting up an online payment system might seem complicated at first glance. But easy-to-use invoicing software takes care of the hard work for you, so you can focus on your business.

What’s the Difference Between Merchant Account & a Payment Service Provider?

Merchant accounts and payment service providers are both viable options for businesses that want to accept credit and debit card payments from their customers. However, there are some key differences between the two that you should be aware of before deciding.

A merchant account is a type of bank account that allows businesses to accept payments by debit or credit card. To set up a merchant account, you’ll need to go through an acquiring bank or a member service provider.

Customers provide their credit/debit card information at your point of sale (POS) system. Then the card processor sends the transaction details to your merchant account. Your merchant account provider confirms with the customer’s card issuer that sufficient funds are available.

Once funds are confirmed, your merchant account provider will front your business the funds for that transaction. The main advantage of using a merchant account is that you’ll have more control over your payments.

Payment service providers (PSPs) offer similar services to merchant accounts, but they don’t require you to set up a separate account. Instead, PSPs will process your payments through their own platform and then deposit the funds into your business account.

PSPs are much easier to set up than merchant accounts, which can be ideal for small businesses just starting out. There’s no lengthy application process and they tend to have lower fees than merchant accounts.

How Can I Accept Credit Card Payments for Free?

Unfortunately, there’s no genuinely “free” way to accept credit card payments online. Just like any other business, payment processors need to cover their costs and turn a profit.

Credit and debit cards have interchange fees that are paid by the merchant’s bank to the cardholder’s bank. Also, all card payments are processed through card networks (Visa, Mastercard, Discover, etc.), and those networks charge a fee for their services.

But you can avoid paying processing fees up front by using a processor that charges per transaction. You can also pass the fees on to the customer by including them in the final cost.

Credit vs. Debit Card Transactions

Payment processors may treat debit card transactions differently than credit card transactions, and there are a few reasons why. For one, debit cards are linked directly to a bank account, which means that the funds are typically available immediately.

This cuts down on the risk of non-payment, which is always a concern with credit card transactions. In addition, debit card transactions usually have lower fees than credit card transactions.

Credit card transactions, on the other hand, are processed through the credit card company first. So, when a customer pays with a credit card, the bank associated with the credit card essentially gives the credit card company a loan that will be repaid by the customer later.

Credit card companies often charge higher fees for processing transactions than debit card companies do because they view credit card transactions as being riskier.

Fees to Consider with Payment Processing

Payment processing fees are charges that businesses must pay to accept payments by credit card or other electronic means. These fees can be charged by the processing company, the credit card issuer, or both.

And though they may seem like small expenses, they can add up quickly for a small business. By understanding some of the different types of payment processing fees and how they work, you can be sure that you’re not paying more than you need to.

Processing Fees: The first type of fee you might encounter is a processing fee. This is a fee charged by the company that processes your credit card payments. Processing fees are typically a percentage of the total transaction amount, plus a fixed fee per transaction.

For example, if you’re being charged 3.5% + $0.50 per transaction, that means you’ll pay $0.50 in addition to 3.5% of the total purchase price whenever someone buys something from your business using a credit card.

Interchange Fees: Interchange fees are set by credit card issuers and paid to the bank that issued the card whenever a transaction occurs. Interchange fees are typically a percentage of the transaction amount, plus a fixed fee per transaction.

For example, if you’re being charged 1.5% + $0.10 per transaction, that means you’ll pay $0.10 in addition to 1.5% of the purchase price whenever someone buys something from your business using a credit card.

Merchant Service Fee: A merchant service fee is a monthly fee charged by some banks or payment processors in exchange for allowing businesses to accept credit card payments. Merchant service fees can range from $10-25 per month, depending on the bank or processor.

Assessment Fee: An assessment fee is charged by Visa and Mastercard and is based on your monthly credit card sales volume. Assessment fees are typically around 0.11% of your monthly sales volume but can vary depending on which cards are used most frequently by your customers (e.g., Visa vs Mastercard).

Depending on which processor, gateway, and plan you choose, there may be additional costs such as:

- Setup fees

- Annual fees

- Monthly subscription fees

- Early termination fees

- Payment card industry, or PCI, compliance fees

- Statement fees

- Monthly minimum fees

- Gateway fees

It’s important to carefully read through the fine print when selecting your payment processor, gateway, or plan. You don’t want to be surprised with fees you weren’t anticipating.

Leading Online/Mobile Payment Processing Providers

Thanks to the rise of online and mobile commerce, businesses now have a range of options when it comes to processing payments. Let’s look at some of the leading payment processing providers and explore the various ways they can help your business accept payments online and on the go.

PayPal

With over 250 million active users worldwide, PayPal makes it easy to send and receive payments from anywhere in the world. They provide the tools necessary to integrate PayPal into your website and set up a secure payment gateway.

PayPal is free to join and best of all, there are no setup or monthly fees. You only pay when you make a transaction.

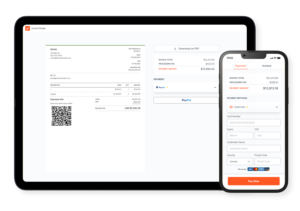

Invoice Simple

Invoice Simple is an invoicing and payment platform that makes it easy to create and manage invoices from your computer or mobile device. With Invoice Simple, you can get paid by credit card, bank transfer, or PayPal.

They have partnered with PayPal to help you get paid faster and easier. A processing fee is subtracted from the total amount paid on each invoice.

Venmo

With over 250 million active users worldwide, PayPal makes it easy to send and receive payments from anywhere in the world. They provide the tools necessary to integrate PayPal into your website and set up a secure payment gateway.

PayPal is free to join and best of all, there are no setup or monthly fees. You only pay when you make a transaction.

Square

Square is a mobile payment processing provider that offers businesses a free card reader to accept credit and debit card payments.

Users only pay per transaction with no long-term contracts or monthly fees. Plus, with Square’s new Cash App, businesses can also accept Bitcoin payments.

Apple Pay

Apple Pay allows users to input contact, payment, and shipping information quickly and safely with only the click of a button. It can be used on websites, in stores, by app, and via Business Chat or iMessage.

Apple Pay doesn’t charge any fees. However, merchants may be charged the typical processing fees by credit/debit card providers.

Google Pay

Google Pay offers a payment tool for businesses, websites, and apps that can be set up in minutes and start accepting payments right away. Google Pay allows Google users to pay online safely and securely at the touch of a button.

Google Pay doesn’t charge its users fees. However, as with Apple Pay, merchants may be charged the typical processing fees by the credit/debit card providers.

Connect Your Customers to Your Online Payment System

As a business owner, it’s important to make it easy for customers to pay you. The easier you make it to connect customers to your payment system, the better it is for your business. Here are a few ways to connect your customers to your online payments system:

Payment Links

Payment links are secure, shareable URLs that connect the user to a personalized payment form. They can be embedded directly into quotes and invoices as well as emails, texts, chats, and messenger apps.

QR Codes

QR codes are one of the most effective ways to add payment links to invoices. They are square barcodes that can be scanned by smartphones. Once scanned, users are routed to a payment portal.

QR codes are convenient for customers who prefer a paper invoice but want to pay online. They can quickly scan the code and authorize the payment rather than mail a check or search for a payment portal online. Not to mention, invoice QR codes help you get paid faster.

Security concerns? QR codes are a secure payment method. They use encryption to protect sensitive information. Plus, you can add further security measures to QR codes, like password protection, to prevent fraud.

And from a business standpoint, QR codes are cost-effective. You don’t need additional hardware or software to generate and display QR codes on your invoices. It’s a simple way to streamline payments without adding additional expenses to your business.

Learn more about how you can include QR codes on your invoices to streamline payments.

Online Invoice Payments

Using an invoice management system with built-in payment portals is a great way to connect customers to your online payment system. Invoice management systems make it easy to create and send viewable invoices.

The built-in payment portals make it quick and easy for customers to pay. Plus, you can use the same system to track payments, so you always know who has paid and who hasn’t. It’s a great way to streamline your online payment process.

Website Portal

Creating a website portal is a great way to streamline the payment process for your customers. A website portal is simply a link between your website and your payment processing provider’s website or platform.

The first step is to choose a payment processing provider that offers website portals. Once you’ve created an account and obtained your login credentials, you’ll be able to access your provider’s portal builder. This is where you’ll configure the look and feel of your portal page.

You’ll want to make sure that the fields on the form are correctly mapped to the corresponding fields on your payment processor’s platform. Once you’re happy with how everything looks, you can publish your portal page and start accepting payments!