How to State Invoice Payment Terms (with Example Wording)

April 25, 2023 by Invoice Simple

There are many things a business owner can put off, but invoicing is not one of them. Timely invoices help ensure a healthy cash flow so you can keep your business running. However, it’s not enough to just tell your customers how much is due. You need an invoice that includes:

- the date of the invoice

- an invoice number

- the total amount due

- payment terms

The last invoice item on our list–payment terms–is what this article focuses on.

Invoice Payment Terms

Payment terms are used to let customers know when and how to pay. For example, net 30 means the invoice total is due in 30 days. In some cases, payment terms incentivize quicker payments by offering a discount. Let’s take a closer look.

What are the best or typical payment terms?

Typical payment terms spell out how much is due, when it is due, if discounts apply, and what methods customers can use to pay. The best terms are clear and easy to understand (we cover this wording in detail below).

How you structure payment terms can be influenced by the industry you work in. For example, many food and beverage suppliers require immediate payment while construction providers are known to allow 90 days for payment. If you don’t know what’s standard in your industry, consider asking in an industry forum, like a field-related r/subreddit.

Do you NEED payment terms on an invoice?

Theoretically, you could skip having payment terms on your invoices but then how will your customers know your expectations for paying you? One of the biggest challenges for businesses is cash flow. To help keep your cash flow healthy always include payment terms on your invoices.

Plus, including payment terms helps you stay in control of the billing process. When you know when invoices are due, you also know when payments are late. Always follow up on late payments—the financial health of your business depends upon it.

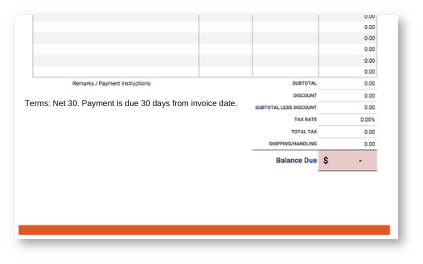

Example Invoice Payment Terms Wording

Adding payment terms to invoices is as simple as adding a note. A short sentence or two is all you need to let customers know when and how they’re expected to pay. Feel free to copy the wording from any of the following examples and paste it in your invoices.

- When payment is required in advance:

Pay in advance.

- When you expect customers to pay right away:

Payment due upon receipt.

- When you extend credit to customers and specify how many days they have to pay:

Terms: Net 30. Payment is due 30 days from invoice date.

Net 30 is standard practice in many industries. If you require faster payment, swap “net 30” for “net 15” or even “net 10.”

- To incentivize faster payments net terms are combined with a discount. For example:

Terms: 5% 10 net 30. If you pay within 10 days, we’ll discount this invoice 5%, or you can pay the full amount due within 30 days

- When you extend a line of credit, and the client pays invoices monthly or quarterly:

Line of credit. - To inform customers what happens if payment is late:

A monthly late fee of 1% of the total amount due will be charged on overdue payments.

RELATED ARTICLE: How to Accept Payments Online

Tips for Making Your Invoice Payment Terms More Effective

Effective invoice terms are clear, as described above. They also show up on every invoice you send. Here more tips on managing your invoices and accepting payments.

Use an invoice management system

An invoice management system allows you to invoice, email, track payments, and follow up on late payments all in one place, without feeling like you need to be an accountant to manage your business.

A robust system allows you to see when invoices are delivered and read, find invoices by client, makes it easy to export data, and is always up-to-date on which invoices are coming due or late.

Use a super simple payment gateway

The more options available for receiving customers’ payments (often called payment gateways) the easier it is to get paid. By accepting multiple forms of payment you also make it more convenient for customers to pay.

Need a better way to get paid?

Write a strong invoice email & follow up

Stay on top of invoicing and late payments like the life of your business depends on it—because it does!

Every successful business has a plan in place for sending invoice emails and following up with customers who don’t pay on time.

Whenever an invoice is even a day late, initiate communication with the customer. Typically, this means sending an email. It’s a good idea to start the conversation with a reminder that payment was expected by the due date. If the customer doesn’t pay or respond, send a second email. If they still don’t pay, don’t give up. MYOB reports that 59% of overdue invoices require three or more follow ups before they get paid.

And if you don’t know what to say in your emails, copy our free templates.

In addition to emailing, you can phone customers who are late on payments. Be courteous. Thank them for their business. Then firmly let them know payment is overdue and ask them to pay via one of your payment gateways.

Offer discounts (& potentially late fees)

Adding a note on a line or two is all it takes to convert a standard invoice into one that

Nobody likes assessing or paying late fees. An alternative to punishing customers for paying late is to reward them with a discount for paying quickly. Remember the term 5% net 10 that provides a 5% discount for paying within ten calendar days? A carrot like this is often better than the stick of late fees.

However, for overdue accounts you may charge a late fee. Typically, late fees are a percentage of the invoice total, such as 1.5%. However, regulations on late fees and interest vary from state to state, so find out what’s legal where you are.

If invoices remain unpaid after several attempts to collect, you may need to take more drastic steps. Options include hiring an attorney or collection agency or filing a claim in small claims court. And if, in the end, you find that you’ve exhausted your options, it may be possible to write off that unpaid invoice (see “Can You Write off Unpaid Invoices?” for more info).

Key Takeaways of Stating Payment Terms on an Invoice

If you’re new to using payment terms, all this can seem like a lot. However, once you understand the terms and start using them on invoices, you’ll improve your cash flow. Here are the key payment terms takeaways:

- Clearly stated payment terms on an invoice let customers know when and how to pay.

- A short sentence or two is all it takes describe your payment terms. You can customize the examples provided in italics above.

- Multiple payment gateways allow customers to pay in a way that’s convenient and helps you get paid on time.

- An invoice management system will simplify your invoicing process, make it easy include payment terms, and keep your cash flow healthy.

- Have a plan in place for sending invoice emails and following up on unpaid invoices as soon as they are overdue.

- Discounts for early payment are an alternative to punishing customers for late payment with late fees.

RELATED ARTICLE: How to Write a Past Due Invoice Email