How to Offer Net 30 Terms (for Small Businesses & Contractors)

April 7, 2023 by Invoice Simple

The lifeblood of every business is cash flow. Small business owners and contractors need money coming in so they can pay their suppliers, employees, and themselves. One way to help maintain steady cash flow is by offering net 30 terms. For many people new to running a business, this common invoicing practice is unfamiliar. Here’s what you need to know about net 30, how net terms can vary, and how you can use net 30 and similar terms to win business and keep cash flowing in.

First things first–a definition. Net terms tell a customer when their invoice is due. Often terms are “net 30” which means the customer has 30 days from the invoice date to pay the bill in full. While 30 days is a common time period, it’s not set in stone. Some sellers bill “net 60” giving their customers two full months to pay their invoice.

Any time you agree to let a customer pay later, as with net 30 terms, you’re extending credit to them. While you may not like the idea of becoming a lender, the practice is a valuable way to establish credibility because extending credit shows your business has healthy cash flow. Plus, it helps build stronger relationships over time.

Ways to Offer Net Terms

Offering “net 30” terms is one of the most common ways to let customers know when you expect to be paid. And in the case of “net 30,” it means you expect to be paid in full within 30 days.

However, it’s not the only way you can structure payment terms. You can offer discounts for paying earlier. For example, you could offer customers a payment term of “5% 10 net 30.” This means your customer receives a 5% discount if they pay their invoice within 10 calendar days. If they wait to pay their invoice on days 11 through 30, they’ll pay the full amount.

The ideal time to inform customers of your net terms is when you quote a price or bid on a job. By putting the terms in writing from the start of the transaction, your customers know when payment is expected and can plan accordingly. This planning time is especially important when you offer a discount for quick payment like “5% 10 net 30.”

A second way to offer net terms is by simply stating them on your invoice. We share exactly how to do this in our related article, “What Does Net 30 Mean on an Invoice?”

KEEP READING: What Does Net 30 Mean on an Invoice?

Trade Credit

When you offer trade credit, you provide your customer with goods and services with the understanding that they’ll pay you later. In effect, you accept an I.O.U. from your customer.

In addition to providing goods or services, you handle:

- invoicing

- accounts receivable

- collections

Advantages & Disadvantages of Trade Credit

For contractors, offering trade credit has several advantages. First, it establishes a relationship based on trust; allowing a customer to pay later lets them know you consider them trustworthy. The relationship then becomes the building block for customer loyalty.

Another advantage to offering trade credit is that it can help you stand out from competitors who don’t offer this financial benefit. Think about this from a customer’s point of view: all things being equal between two contractors, is it better to choose the one who wants payment up front or one who will allow payment a month from now? Customers like the financial wiggle room trade credit allows, and you could use net terms as a negotiating tool to win a new account.

On the flip side, there are some drawbacks for your business when offering trade credit. First, it takes more time to bill customers, monitor accounts, and follow up when payments aren’t made on time. Though, there are companies like TreviPay that help small businesses manage the trade credit process.

Second, you may need to run a credit report on customers to make sure they’re creditworthy. This means added expenses to obtain reports from services like Dun & Bradstreet, and added time spent evaluating those reports and making decisions about extending credit.

The third disadvantage of offering trade credit is a biggie: it delays when you get paid, and this directly affects your cash flow. While most people and companies pay their bills on time, some pay slowly, and others don’t pay at all. New businesses or those experiencing a slump can face a serious financial crunch if they don’t have enough cash reserves to keep their own bills paid while waiting for customer payments to arrive.

Invoice Factoring: Get Cash Faster–For a Fee

If you have an unpaid invoice and think it’s worthless until the customer makes a payment, think again. A service called invoice factoring can put cash in your account right away; however, it won’t be for the full invoice amount.

With invoice factoring, you sell the debt owed to you, at a discount, to a factoring company. In most cases, the factoring company advances up to 90% of the invoice amount, often within a day.

Let’s look at how this works with some hypothetical companies. Sunshine Company LLC has a customer invoice f

The key benefit of invoice factoring is that it gives you access to working capital faster. However, the convenience of fast cash comes at cost that can erode your profit.

There are many invoice factoring companies, but each sets their own terms, so you need to closely examine what each offers. For example, some companies offer a very low rate, say 1%, but this rate might be weekly with a stipulation that it rises 1% each week. In 30 days, your rate becomes 4%. Customer doesn’t pay for 60 days? That rate is up to 8%. Read the terms carefully before you commit.

Also, there’s still a risk of non-payment. The terms of the contract with the invoice factoring company will determines what happens if a customer doesn’t pay.

If the contract includes a recourse factor, you may be required to buy back the debt from the factoring company. If the terms specify a nonrecourse factor, you’re off the hook for the unpaid amount. However, a nonrecourse factor will come with a higher fee because the factoring company is taking a higher risk.

Your company might also get hit with additional expenses if your customer pays late or their check doesn’t clear and there are returned check fees.

For some companies, invoice factoring is a valuable tool for improving cash flow. And unlike a secured bank loan, the money can be spent any way you choose. However, the ease of borrowing needs to be weighed against the costs to see if it makes sense for your situation.

or $10,000. They turn to Fab Invoice Factoring for an advance. Fab’s terms allow for a 90% advance with a 4% fee. So the fee will be $400. 90% of $10K is $9,000. $9,000 minus the $400 fee, means Sunshine gets $8,600 right away. When the customer pays, Sunshine receives the remaining $1,000.

Factoring fees vary among service providers. If you use invoice factoring, make sure you understand all the terms and rates before signing up.

Advantages & Disadvantages of Invoice Factoring

The key benefit of invoice factoring is that it gives you access to working capital faster. However, the convenience of fast cash comes at cost that can erode your profit.

There are many invoice factoring companies, but each sets their own terms, so you need to closely examine what each offers. For example, some companies offer a very low rate, say 1%, but this rate might be weekly with a stipulation that it rises 1% each week. In 30 days, your rate becomes 4%. Customer doesn’t pay for 60 days? That rate is up to 8%. Read the terms carefully before you commit.

Also, there’s still a risk of non-payment. The terms of the contract with the invoice factoring company will determines what happens if a customer doesn’t pay.

If the contract includes a recourse factor, you may be required to buy back the debt from the factoring company. If the terms specify a nonrecourse factor, you’re off the hook for the unpaid amount. However, a nonrecourse factor will come with a higher fee because the factoring company is taking a higher risk.

Your company might also get hit with additional expenses if your customer pays late or their check doesn’t clear and there are returned check fees.

For some companies, invoice factoring is a valuable tool for improving cash flow. And unlike a secured bank loan, the money can be spent any way you choose. However, the ease of borrowing needs to be weighed against the costs to see if it makes sense for your situation.

Offer BNPL (Buy Now Pay Later)

Buy Now Pay Later (BNPL) has become one of the most popular ways for consumers to pay for purchases since the COVID-19 pandemic. Consumers see it as way to use credit without running up credit card balances or affecting their credit score.

Often BNPL services split a purchase into four equal and interest-free payments. Consumers make the first payment at the time of purchase, then make the remaining three payments every two weeks.

PayPal takes BNPL a step further. In addition to a Pay in 4 plan, they offer a Pay Monthly plan. Their monthly payment plan is for purchases between $199 and $10,000 and charges interest of 9.99% to 29.99% APR. The repayment period ranges from six months to two years.

By the way, Invoice Simple has partnered with PayPal so you can offer your customers the convenience of BNPL in four payments. When you opt to use this service, customers will see a “Pay Later” button on their invoice. The cash, less a processing fee, is deposited in your account within 48 hours of each of the four payments.

Advantages & Disadvantages of BNPL

For sellers and service providers, BNPL is a mixed bag. On the plus side, BNPL increases conversion rates (more lookers become buyers) and average order value goes up. On the minus side, the third-party financing company charges a fee that can range from 2% to 8% of the order total.

And while consumers love the advantages of BNPL like interest-free borrowing, if they’d like to make a return or get a refund, things get complicated because a third party is involved in the transaction. The way a BNPL financer handles customer problems will reflect on your business and its reputation.

Perhaps the most compelling reason to offer BNPL is that it offers your company a competitive advantage over providers who don’t.

Need an easier way to get paid?

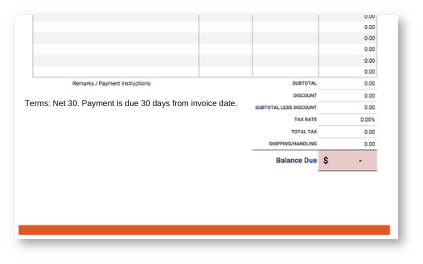

How to Add Net 30 to an Invoice

When you decide offer net 30, the terms need to be included on your invoice. Whether you operate with an old-school manual system or automate invoicing with an app like Invoice Simple, the following are some ways you can let your customers know about payment terms.

Net 30 Payment Terms Wording

Adding a note on a line or two is all it takes to convert a standard invoice into one that offers net 30 terms.

The simplest way to describe your terms gets right to the point:

Payment terms: Net 30. Payment is due 30 days from invoice date.

or

Balance due within 30 calendar days.

How you phrase your terms on an invoice doesn’t matter as long as you are specific. However, if you think of an invoice as a point of communication with your customers, you can give your terms a more personal touch.

Offer net 30 terms with appreciation and a date reminder:

Thanks for your business. Our payment terms are Net 30. Kindly pay in full by December 14, 2023.

Get conversational:

We enjoy working with you and appreciate your business. Our net 30 payment terms mean we’ve extended free credit to you. Please pay this invoice within 30 days of the date above. We accept cash, checks, credit cards, and debit cards. Thanks in advance!

Casually call out an incentive:

Hey there—our standard payment terms are net 30. However, if you pay within 10 days, we’ll discount this invoice 5% as our way of thanking you for prompt payment. If you want to pay the full invoice amount in 30 days, that’s cool too!

Tips for Improving Your Net Terms/Net 30 Process

Extending credit with net 30 and similar terms is only part of managing accounts receivable. Your system needs to ensure invoices are sent and tracked, that customers have an easy way to pay, and that you have procedures for following up with customers who don’t pay on time.

Create Good Email Procedure

Most often, invoices will be delivered via email. A clear, concise subject line and message help your customer identify the invoice and what it for. If you’re new to writing invoice emails, check out our guide, How to Write a Strong Email Invoice with three examples you can start using right away.

Use an Invoice Management System

While you could use a manual system requiring a complex spreadsheet and creating individual invoices, there are easier, more efficient ways to keep your business finances organized. An invoice management system allows you to invoice, email, track payments, and follow up on late payments all in one place, without feeling like you need to be an accountant to manage your business.

Issue Invoices Quickly

Even with an invoice management system, you can run head-first into cash crunch if you don’t send invoices. Make it a habit to create and send invoices as soon as work is done or products delivered. Staying current on invoicing will help keep cash flowing in.

Revoke Net 30 Terms for Slow Paying Customers

Customers who receive net 30 terms and pay late abuse your generosity. If you wish to continue working with slow paying customers, implement a policy of requiring cash upon delivery. At a later date, you could choose to extend to credit again—or not.

Let Customers Know What Happens if Payments Are Late

Whenever you enter into an agreement for work, your written agreement should cover what happens if payment is late. In most cases, interest will be charged. The legal limits for annual interest rates varies from state to state, so research what’s allowed where you work before you set late fees.

You can also inform customers what happens if they pay late with a line on the invoice. If you don’t know what to say, swipe the examples from our guide on charging late fees.

Invoice Simple makes adding a note about late fees to an invoice super easy–try it out free.

Use a Simple Payment Gateway

One factor in getting paid on time when you offer net 30 terms is the ease—or difficulty—for customers to make their payment. A payment gateway makes things simple and keeps your customers’ payment info secure.

Let’s face it, dealing with unpaid invoices is one of the least fun parts of being a small business owner. But it’s a necessary evil, and there are ways to handle it that don’t involve losing your cool (or your mind).

Need a user-friendly payment gateway?

Key Takeaways of Offering Net 30 Terms

Here are the key takeaways on offering net 30 terms:

- Offering net 30 terms means you extend credit to you customers.

- Net terms can vary and include a discount for quick payments (for example 5% 10, net 30).

- Net terms can be an incentive as well as a negotiation tool to win more business.

- Net 30 helps keep cash flowing in, but your company needs enough cash reserves to cover expenses in case customers are slow to pay.

- Net terms mean you, or someone you hire, must closely monitor accounts receivable and follow up on late payments.

- Invoice factoring can bring in cash on net 30 invoices quicker for a fee paid to a third-party factoring company.

- Buy Now Pay Later (such as PayPal’s Pay in 4) is an additional way to offer credit and make it easy for customers to pay.

- Invoice as soon as work is done or products are delivered, and include net terms and late fee information in your contracts and invoices.

- Payment gateways allow customers to pay multiple ways and helps you get paid on time.

- An invoice management system will simplify your invoicing process, make it easy to offer net 30 or other payment terms, and stay on top of unpaid invoices.