5 Steps to Keep Track of Business Expenses

September 15, 2023

In the dynamic and intricate world of business, maintaining a clear and comprehensive record of business expenses stands as a foundational practice that can make or break your company’s success. The ability to effectively track business expenses is not only a matter of financial prudence but also an act that directly impacts your business’s overall performance.

However, tracking business expenses can be a tedious and difficult exercise. It’s no surprise that 57% of businesses say the lack of visibility is their biggest spend-related concern. Finance teams and managers usually don’t know what’s been spent until the end of the month when an overwhelming number of claims flood in, which is why it’s so important to continuously track business expenses.

Implementing a Centralized System

Using a centralized system for tracking business expenses and keeping things organized can greatly enhance the efficiency, accuracy, and overall management of your company’s financial operations. Having everything in one place, under a streamlined process, simplifies the effort involved in tracking numerous expenses.

By consolidating all their expense-related data in a single platform, such as accounting software, businesses can achieve both heightened efficiency and accuracy. Accounting software, for example, eliminates the chaos of scattered records and simplifies the process of recording, categorizing, and analyzing expenditures. Beyond streamlining day-to-day operations, a centralized approach also ensures compliance with regulatory requirements, facilitating smoother audits and minimizing legal risks.

The organization enabled by accounting software is also a vast improvement compared to manually keeping track of documents, receipts, and other financial records. Ultimately, the use of a centralized system elevates a company’s organizational efficiency, becoming a pivotal instrument in nurturing financial health, transparency, and sustainable success.

Using Spreadsheets vs. Expense Tracking Software

Roughly 30% of businesses still use spreadsheet software like Excel to keep track of business expenses. However, as the adoption of business expense tracking software becomes more widespread, the use of spreadsheets is also becoming noticeably less effective. Using spreadsheets offers flexibility but is limited in terms of automation and advanced features. Alternatively, all-inclusive billing software provides structured tracking, automation, collaboration and more, making it a comprehensive solution for efficient and accurate expense management.

The benefits of using expense tracking software vs. spreadsheets include:

- Error management: Studies show that 19% of expense reports contain an error. Automated accounting software can significantly reduce the risk of errors by removing manual data entry.

- Time management: Entering and analyzing data in spreadsheets is time-consuming. When you use an accounting system to track expenses, these long tasks are completed automatically. The software can consolidate data and perform necessary analysis, saving time for submitters, approvers, and finance teams.

- Security: Shared spreadsheets are easily accessible, which is also a dangerous risk. Storing business expense data in an accounting system provides more security through encryption and by limiting the access to the expense tracking spreadsheet.

What Details are Important to Track

To properly track business expenses, you must first know which details to track, including:

- Date: Day, month and year are all important information

- Amount: How much was spent

- Vendor: Who was paid

- Expense Category: Put expenses into relevant categories (travel, office supplies, utilities, etc.)

- Receipt/Invoice Number: Attach or reference the receipt or invoice number for verification

- Payment Method: Specify whether the payment was made through cash, credit card, check, or another method

- Spender: Who made the expense

- Mileage Details: For travel-related expenses, record mileage, starting and ending locations, and purpose of travel

Need a better way to track your business expenses? Invoice Simple can help.

Step 1: Know What Counts as an Expense

Here are some common business expenses:

- Advertising and marketing costs

- Bank fees

- Credit card processing fees

- Education and training expenses for employees

- Employee benefits programs

- Equipment rentals

- Insurance premiums

- Legal fees

- Rent or office fees

- Office supplies

- Business travel expenses

- Food and drink for business trips or dining meetings

- Food and beverages supplied in the workplace

- Internet expenses

Step 2: Centralize Your Banking & Finances

Centralizing business bank accounts is another important step in tracking expenses, and it can be advantageous for your business overall. With your information in one place, keeping track of business expenses is much easier than trying to manage multiple accounts at multiple banks.

Saving time and reducing redundancies is one of the benefits that comes with centralizing bank accounts. In fact, 63% of companies that have multiple accounts have received duplicate invoices resulting in paying for the same thing more than once. Centralized banking can help save wasted money.

When banking is not centralized, your company might also spend a lot of time consolidating information. This is not only a waste of time, but it increases the chance of errors. Centralizing bank accounts makes the process of tracking expenses simpler and easier and can increase productivity.

A few ways to centralize finances:

- Establish a team to oversee and coordinate all cash accounting activities across your organization

- Use accounting software

- Integrate bank accounts and credit cards with the software

- Create workflows for everyone to follow when tracking expenses through the software

Step 3: Set Up an Expense Tracking System

Setting up an expense tracking system may seem like a daunting task at first. Maybe your company is used to doing it another way, or you’re a small business just starting out and need to learn to track expenses from scratch. Despite requiring some initial work, once it’s set up, expense tracking software will pay off by improving your company’s billing process.

Choosing the Right Expense Tracking Software or Tool

Here are key features and considerations to look for when evaluating expense tracking software options:

- User-friendly interface: An intuitive and user-friendly interface that allows easy navigation and quick adoption by your team.

- Expense categories: Look for software that allows you to create and customize expense categories to match your specific needs.

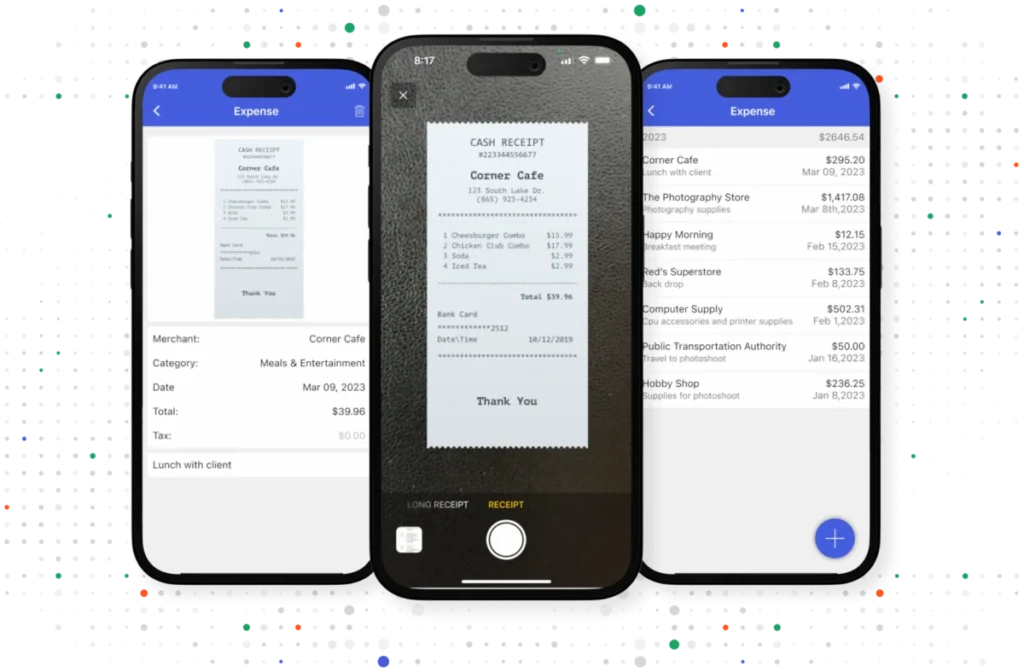

- Receipt capture and attachment: The ability to capture and attach receipts digitally using mobile devices or scanners helps streamline expense reports.

- Automation: The software should offer automated features like expense categorization, currency conversion, and calculation of taxes.

- Integration: Consider software that integrates with your accounting or financial management systems, making it easier to synchronize expense data and streamline workflows.

- Policy enforcement: The software should allow you to define and enforce expense policies, which prevents inappropriate or non-compliant spending.

- Reporting and analytics: The software should have the capacity to analyze the data and provide insights.

- Customization: The software should allow you to customize fields, workflows, and reports to match your business’ unique requirements.

Step 4: Reconcile and Report

Reconciling expenses is a critical practice in financial management that involves comparing and aligning various financial records to ensure accuracy, completeness, and consistency. Once reconciling is completed, expense reports are also a major part of the process to compile and evaluate the data.

How to Reconcile Expenses

- Compare bank statements with your company’s internal records.

- Investigate discrepancies, they could be caused by timing differences, errors in data entry, or other factors.

- Account for outstanding items by noting any expenses that haven’t cleared the bank or credit card statement yet, such as checks that haven’t been cashed or pending transactions.

Generating Reports and Identifying Trends

Once business accounts have been reconciled, it’s time to generate reports. Expense reports help identify, anticipate, and understand trends. Tracking and reconciling expenses prevents errors, thus leading to more accurate reports.

Having detailed reports of all expenses throughout the year also helps keep everything organized for tax time. When it comes time to file, things like your organization’s taxable business income and tax deductions will be readily available.

Step 5: Storing and Backing Up Data

Backup data is a vital lifeline for businesses and individuals in a digital landscape filled with hardware failures, cyber threats, and accidental deletions. Even if you’re using cloud software, it is important to have another digital backup.

How Long Do I Need to Keep Business Receipts?

Time frames for holding on to business receipts will vary depending on location. Different countries, as well as different states inside the U.S., will have different requirements. The IRS recommends keeping business receipts for a minimum of three years. There are also cases where keeping records is required for seven to 10 years.

Choosing a Secure Storage Method for Digital Financial Records

Most databases have security systems in place to store information and backups. Accounting software systems also have security features like encryption. Even if you are not using expense tracking software, it is still important to securely store backups. Here are some ideal ways to do so:

- Use strong passwords and two-factor-authentication to access all company computers

- Use firewalls and VPNs

- Limit outside media like thumb drives

- Be wary of scams and phishing

Implementing Regular Data Backups

You must implement a good backup strategy to ensure no data is lost or stolen. Backups should be done at least once a week, but every 24 hours is the preferred method, and stored as long as necessary. Keep backups for any amount of time required by law for taxes. It’s safe to delete backups when they have become obsolete and have not been looked at for months or even years.

Tips and Best Practices to Streamline Your Billing Process

Keeping track of expenses is a multi-layered process. Between juggling bank accounts, holding onto digital and paper receipts, identifying valid business expenses, and more, it’s easy to get lost and slip up. Luckily, there are ways to make the process easier.

Integrating Expense Tracking with Accounting

Expense tracking and accounting should work harmoniously. Expense reports that can easily be shared with accountants will help any business stay on top of things. Make sure to have a good system in place so that information flows smoothly to the accounting department.

Using a Receipt Scanner for Faster Transactions

Tracking software should include, or be compatible with, a receipt scanner. Integrating software and scanners will make the process of inputting information from paper receipts faster, and automation helps reduce the chances of human error.

Stay Organized and Consistent with Record-Keeping

Staying current with all expense records is very important. Set aside a small amount of time each week, dedicated to expense tracking and reporting. Logging expenses monthly is also a common practice, but it’s also problematic. Monthly logging leaves finance teams with a large amount of work to do all at once at the end of the month. The rush to get everything recorded accurately can lead to more errors, with no time to make corrections.

Continuously Evaluate and Improve Your Expense Process

Analyze and evaluate your expense tracking process regularly to detect any problems. Having a smooth workflow not only improves businesses internally, but externally as well. Taxes and accounting will be much quicker and simpler when the workflow is constantly improved.

Keeping track of business expenses is both a crucial and difficult aspect of your company’s success. There are many moving parts in the process, but fortunately there are also many helpful tips and guides to help you. Most importantly, the use of accounting software instead of spreadsheets can help you stay organized and operate more efficiently when tracking business expenses. It will not only help save you time and money, but it will also make the entire process run smoother.