Invoice Versus Receipt Basics: Everything Business Owners Need to Know

January 25, 2023 by Invoice Simple

If you’re a business owner, you’re no stranger to paperwork, especially when it comes to invoices and receipts. And these documents may seem similar at first glance. But they serve very different functions in your financial recordkeeping.

Understanding how they’re different helps keep your business finances organized.

In this article, we’ll take a closer look at invoices versus receipts. We’ll cover when to use each one, what information to include, and how to manage them effectively. By the end, you’ll have a clear grasp of these critical financial documents and be able to handle them like a pro.

What Is an Invoice?

An invoice is a document a business sends to a customer when it’s time for the customer to pay for goods or services. It details what the customer has purchased and how much they owe. They also have due dates, so it’s clear when the payment is due.

Invoices play a crucial role in managing a business’s finances because they help track money owed and the date payments are due. They request payment with all the information customers need to understand their charges. Invoices usually also contains information on how to make the payment.

RELATED ARTICLE — What is a Commercial Invoice?

How To Write an Invoice

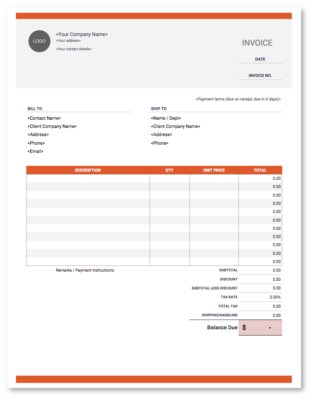

Need a professional Invoice Template? Try one of our free templates.

Now that you know what an invoice is and why it’s important, let’s learn how to create one. Writing an invoice might seem tricky at first, but it’s pretty simple once you know what to include.

1. Start With Your Business Information

Put your business name, address, phone number, and email at the top of the invoice. If you have a logo, include that, too. This helps establish your brand and makes it easy for the customer to identify who the invoice is from.

2. Add the Customer’s Information

Below your business information, write the customer’s name and contact details. This helps ensure you’re sending the invoice to the right person. Check that all the information is accurate to avoid any confusion or payment delays.

3. Assign a Unique Invoice Number

Give each invoice a unique number to make it easier to organize your invoices and refer to them later if needed. This could be as simple as “Invoice #001” and count up from there.

4. Include Dates

Note the date you created the invoice and the date the payment is due. This helps both you and the customer stay on top of payment deadlines.

5. List the Goods or Services Provided

Make a clear, itemized list of what the customer is paying for. Include a brief description of each item, the quantity, and the price. This breakdown helps the customer understand the charges, which can reduce disputes or questions later on.

6. Calculate the Total Amount Due

Add up the cost of all items, including any taxes or fees. Clearly display the total amount owed at the bottom of the invoice. Double-check your math to ensure accuracy.

7. Clarify Payment Terms

Explain how you want to be paid (cash, check, credit card, etc.). Include where to send the payment and outline any late fees or interest charges that may apply. Detailed payment instructions can help you get paid faster and avoid misunderstandings with the customer.

By following these steps, you’ll create a professional, easy-to-understand invoice. Remember: Clear invoices reduce confusion and payment delays.

RELATED ARTICLE — How to Send an Invoice

What Is a Receipt?

Invoices might sound like receipts. So, is a receipt an invoice? Not quite.

A receipt is a document that proves a customer has paid for goods or services. It’s a confirmation that money has changed hands and the transaction is complete. Invoices are sent before payment, while receipts are only issued after the customer has paid. Receipts also tend to be simpler and less detailed than invoices.

Receipts are essential for both businesses and customers. For businesses, they provide a record of sales and help with accounting and tax purposes. For customers, they serve as proof of purchase. They’re also used for returns, exchanges, and warranty claims.

A receipt is a simple but important document that confirms a customer’s payment. It helps both businesses and customers keep track of sales and purchases, and it serves as evidence of the transaction.

How To Write a Receipt

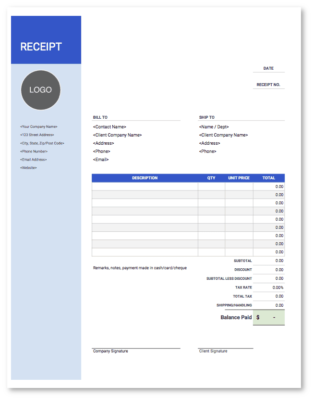

Need a professional Receipt Template? Try one of our free templates.

Receipts may be small, but they play a big role in keeping your business running smoothly. That’s why it’s important to know how to write a receipt that includes all the necessary information.

Here’s a step-by-step guide to writing a complete receipt:

1. Include Your Business Information

Start by putting your business name and contact details at the top of the receipt. This helps the customer remember where they made the purchase and how to reach you if needed.

2. Add the Date and Time

Note the date and time of the transaction. This is important for recordkeeping and can help resolve any issues that may come up later.

3. Assign a Unique Receipt Number

Give each receipt a unique number, just like with invoices. Invoice numbers help you keep track of your sales and make it easier to find specific transactions.

4. List the Items or Services Sold

Write down what the customer bought, including a brief description and the quantity of each item. If you sold services, describe what you did and how much time you spent on each task.

5. Include the Prices

Next to each item or service, write down the price. Make sure to include any sales tax charged.

6. Calculate the Total

Add up all the prices to get the total amount the customer paid. Double-check to make sure everything is correct.

7. Note the Payment Method

Write down how the customer paid, whether by cash, credit card, or another method. If they paid with a card, you might also want to include the last four digits of the card number for reference.

8. Sign and Give to the Customer

Finally, sign the receipt and give it to the customer.

By following these steps, you’ll create a clear, professional receipt that documents the sale and gives the customer a record of their purchase. Remember, the simpler and more straightforward your receipt is, the easier it will be for both you and the customer to understand.

Key Differences Between Invoices and Receipts

Now you know what invoices and receipts are and how to create them. But you might still be wondering, “What’s the difference between an invoice and a receipt?” While both documents are important for keeping track of sales, they have distinct purposes. They’re also used at different stages of a transaction.

Here’s a quick breakdown of the main differences between invoices and receipts:

- Timing. You send an invoice as a request for payment before actually receiving a payment. Receipts are provided after receiving payment as proof of the transaction.

- Purpose. The primary purpose of an invoice is to request payment for goods or services. In contrast, the main purpose of a receipt is to confirm that a payment has been received.

- Amount of Detail. Invoices include more detailed information about the goods or services provided. This includes item descriptions, quantities, and individual prices. Receipts are usually more concise, focusing mainly on the total amount paid and the payment method used.

- Accounting. In accounting, invoices track accounts receivable. This is money owed to the business by customers. Receipts track sales revenue, which is the amount earned by the business from sales.

RELATED ARTICLE — How to Write an Invoice for Freelance Work

Tips for Managing Receipts and Invoices

Keeping your financial documents organized can save you time, money, and a lot of headaches. Here are some tips to help you stay on top of your receipts and invoices:

- Use a Separate Business Bank Account. Mixing your personal and business finances can get messy quickly. Consider opening a dedicated bank account to keep things separated and make it easier to track your income and expenses.

- Keep Your Invoices Numbered and Organized. Use a sequential numbering system for your invoices and keep them in a logical order, such as by date, client, or project.

- Digitize Your Receipts. Instead of letting paper receipts pile up, consider using a scanner or a receipt scanning app to digitize them. This makes it easier to store, organize, and search for receipts when you need them.

- Follow up on Unpaid Invoices. Don’t let unpaid invoices slip through the cracks. Set reminders to follow up with clients who haven’t paid on time. Think about setting clear payment terms and penalties for late payments to encourage timely transactions.

- Set Aside Time for Bookkeeping. Schedule a regular time each week or month to review and update your financial records. This will help you stay on top of your invoices, payments, and expenses and catch any issues early on.

RELATED ARTICLE — What is an Invoice Factoring?

Create Estimates and Invoices Instantly

Get your invoicing done in minutes, not hours. Create estimates and invoices on the road or at home. Quickly add details such as discounts, payment instructions, due dates, photos, signatures, shipping details, and more.