How to Send an Invoice

December 20, 2023

You know that managing finances can be a bit of a puzzle. But here’s the good news: learning how to send an invoice doesn’t have to be complicated.

In this article, we’re going to break down the process of invoicing into easy, manageable steps.

First, we’ll explore how having a solid invoice process can significantly speed up your payment cycle. Then, we’ll delve into the essentials of crafting an invoice that includes all the necessary details your clients need.

We’ll also introduce you to the world of invoice generators. Plus, we’ll discuss the advantages of sending invoices via email and share best practices for doing it effectively.

Finally, we’ll round up some top tips for ensuring timely payments. These strategies will help you maintain a steady cash flow, which is crucial for the health and growth of your business.

Let’s get started on the path to a more efficient and profitable invoicing process.

How Your Invoice Process Can Help You Get Paid Faster

Getting paid faster is a critical goal for businesses. To achieve this, having an effective invoice process is key.

Here’s why it matters and how it can improve your payment turnaround time:

Send Invoices Quickly

Send your invoices right after you finish a job or deliver a product. This helps you get paid faster because clients pay quickly when the work is fresh in their minds. It also prevents them from forgetting about the payment.

Use Professional Invoice Templates

Use professional-looking invoice templates. They make your business seem more organized and trustworthy. Clients are more likely to pay professional-looking invoices. Templates also reduce errors, which can slow down payments.

Automated Reminders

Automated invoice reminders help you remind clients about their payments. They make sure your invoices stay on their radar. Automation saves you time because it sends reminders for you. Clients get reminders without you having to ask for payment.

Clear Payment Terms

Write clear payment terms so clients know when they need to pay. This reduces confusion and prevents delays. Professional invoices show that you expect timely payment.

RELATED ARTICLE: How to Offer Net 30 Terms (for Small Businesses & Contractors)

Keep Good Records

Keep your records organized. It helps you track sent invoices, paid invoices, and ones that are waiting for payment. This makes it easier to follow up.

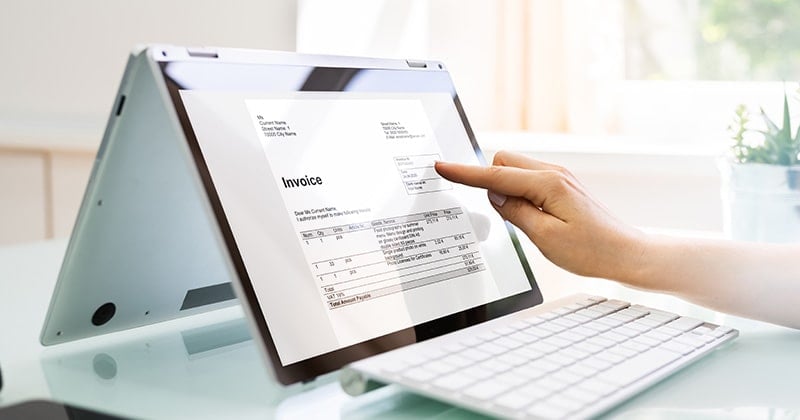

Making Sure Your Invoice Includes Everything the Client Needs to Know

If you want to know how to send an invoice that gets you paid fast, include these details:

- Your Business Information: Include your business name, address, phone number, and email. This way, clients know how to reach you.

- Invoice Details: At the top, clearly write “Invoice” and give it a unique number. This helps you and your client keep track.

- Client’s Info: Put the client’s name and address on the invoice. Make sure it’s accurate to avoid confusion.

- Dates: Include the date you create the invoice and the due date for payment. This tells your client when they need to pay you.

- Supply Date: Mention when you did the work or delivered the products. It helps clients understand what they’re paying for.

- Service/Product Info: Describe the services or products you provided. Be clear and specific so there’s no confusion.

- Amounts: Show the cost for each item separately. It makes the invoice transparent.

- Total Amount: Add up all the costs, including any taxes and discounts. This is the final amount your client needs to pay.

- Payment Terms: Explain the payment terms, like “net 30 days” or “upon receipt.” It tells your client when they should pay.

- Payment Methods: List the ways your client can pay you, whether it’s by check, credit card, or online payment.

- Say Thanks: End your invoice with a polite thank-you note. It’s a nice touch that shows your appreciation.

Including these details makes your invoice clear and easy to understand for your clients.

RELATED ARTICLE: When Should You Use Progress Invoicing?

How to Make an Invoice Using an Invoice Generator

An invoice generator is a user-friendly tool. It’s designed to simplify the process of creating invoices for your business. It’s like having an efficient assistant at your fingertips. And it handles your invoicing needs effortlessly.

To make an invoice with an invoice generator:

- Choose a tool.

- Add your business details.

- Customize with logo, colors, and fonts.

- Input client details.

- List products/services.

- Let it calculate totals.

- Set payment terms.

- Include any notes.

- Review and send.

- Track payments.

- Record transactions.

Here are some of the benefits of using an invoice generator.

Faster Invoice Generation

When you use an invoice generator, you can create professional invoices in a matter of minutes.

These tools are designed to streamline the invoicing process. They eliminate the need for manual calculations and formatting adjustments. This means you can spend less time on paperwork and more time growing your business.

Professional Look

Invoices generated through these tools often have a polished and professional appearance. This is crucial because a professional-looking invoice reflects positively on your business.

It conveys a sense of trust and reliability to your clients, making them more likely to pay promptly.

Consistent Brand Identity

Maintaining a consistent brand identity is essential for any business. Invoice generators allow you to customize your invoices with your logo, colors, and fonts.

This ensures that your branding remains consistent across all customer touchpoints. It reinforces your brand’s visual identity and professionalism.

Security

In today’s digital world, consumers are cautious about scams and cyber threats.

When you use a reputable invoice generator, you can enhance the security of your invoicing process. These tools often come with built-in security features. This protects your financial information and that of your clients.

Less Admin, Fewer Overheads

Manual invoicing can be a time-consuming and labor-intensive task.

It involves creating, printing, and mailing invoices. This adds to your administrative workload and overhead costs.

Invoice generators automate these processes, reducing administrative tasks and overhead expenses. This means you can allocate your resources more efficiently.

Automatic Calculations

Say goodbye to manual calculations and the risk of errors. Invoice generators automatically calculate totals, taxes, and any discounts or additional charges. This ensures accuracy in your invoices. This saves you time and minimizes billing discrepancies.

Try It Out

Invoice Simple’s online invoice generator is a user-friendly and reliable tool that can improve your invoicing process.

Give it a try, and experience how it can benefit your business.

How to Deliver an Invoice via Email

Want to know how to send an invoice? One way is email.

Sending invoices through email is a smart way to ensure quick and smooth payments. Here’s why it’s a great choice:

- Speed: Emailing invoices means clients receive them instantly, allowing for prompt payment.

- Security: Email reduces the risk of invoices getting lost in the mail.

- Record Keeping: Emailing keeps a digital record for bookkeeping and taxes.

- Convenience: Clients can pay easily by clicking a link.

When sending invoices via email, follow these best practices:

Write a Clear Subject Line

Use a subject line that clearly indicates it’s an invoice.

A clear subject line tells the recipient what the email contains without them having to open it. It’s like labeling a package so you know what’s inside before you open it.

If you’re sending an invoice to a client named Z Solutions, your subject line could be: “Invoice for Z Solutions – November 2023.”

This subject line lets your client know that the email contains an invoice. It also specifies which month it’s for.

Include Text in the Email Body

The email body is where you can include a friendly message to your client. It’s like a polite note you might leave in a letter.

This message can also serve as a gentle payment reminder.

You can use a template for this section. For example, you can write a short message like:

“Hello [Client’s Name], I hope this email finds you well. Please find attached the invoice for our services rendered in October. Kindly review it at your earliest convenience. Thank you for your prompt payment.”

Attach the Invoice as a PDF

Send the invoice as a PDF for compatibility and formatting. This keeps everything neat and organized, so your client can easily read and print it.

Ensure Payment Ease

This means giving your client simple directions on how they can give you the money. Just like telling someone which road to take, you want to guide them to the right path for payment.

Whether it’s through a bank transfer, credit card, or any other method, make it clear.

Use Software

To streamline your invoicing, consider using software like Invoice Simple. It automates tasks, tracks payments, and sends reminders, saving time and effort.

8 Tips for Sending Your Invoice to Get Paid on Time

Ready to improve your cash flow with timely payments? Follow these eight tips.

Tip 1: Send Invoices Fast

One essential way to ensure you get paid on time is to send your invoices fast.

As soon as you’ve completed your work or delivered your products, don’t delay. Create and send the invoice right away.

This practice has several benefits.

First, it keeps your services fresh in your client’s mind. The sooner they receive the invoice, the more likely they are to remember the value you provided.

Second, it demonstrates your professionalism and commitment to timely payment. Clients appreciate receiving their invoices on time. It shows that you’re organized and serious about your business.

Consider using invoicing software like Invoice Simple. It simplifies invoice creation and delivery. This allows you to send invoices quickly, which, in turn, helps you get paid faster.

Tip 2: Include Clear Payment Terms

Clear payment terms are crucial for getting paid on time.

They outline when payment is due so your clients know exactly when they need to pay. This transparency helps prevent misunderstandings and delays.

It helps you get paid on time because clients have no uncertainty about their payment obligations. When your payment terms are clear, there’s less room for disputes or confusion. Clients appreciate the clarity, and it fosters trust in your business.

To implement this tip, make sure your invoices specify the due date. Also, note any late fees for delayed payments.

RELATED ARTICLE: How to State Invoice Payment Terms (with Example Wording)

Tip 3: Always Follow Up

Following up on your invoices is a key step in ensuring timely payments. Sometimes, clients may forget to pay or overlook your invoice.

That’s where a friendly follow-up helps. It serves as a gentle reminder to your clients.

Your follow-up message can include a payment reminder. It should also have any necessary instructions on how to pay.

Set a schedule for follow-up messages. Send a polite reminder a few days before the due date and another if the payment becomes overdue.

Invoicing software often provides automated reminders, making this process more efficient.

Tip 4: Use Software to Keep Track

Software that manages your invoicing process is a game-changer. It helps you stay organized.

Software allows you to create and send invoices, monitor payments, and access your invoicing records.

Explore invoicing software options and choose one that aligns with your business needs.

Tip 5: Accept Online Payments

Accepting online payments is a modern way to ensure prompt payment. When clients can pay online, it’s convenient for them and speeds up the payment process.

It helps you get paid on time because online payments are fast and hassle-free. Clients can pay with a few clicks. This reduces the chances of delays associated with traditional methods like checks.

To get started, set up online payment options for your clients. Consider using payment processing services like PayPal, Stripe, or Square. Mention these options on your invoices, making it clear how clients can pay online.

Tip 6: Send Your Invoice to the Right Person

Sending your invoice to the correct person is crucial. It ensures that the person responsible for making payments receives the invoice.

When the right person gets the invoice, they can take immediate action. If the invoice goes to the wrong person, it may get delayed or overlooked.

Confirm with your client who should receive the invoice. Double-check their contact details. Send the invoice directly to their email or preferred communication channel.

Tip 7: Charge a Late Payment Fee

Including a late payment fee in your terms can encourage clients to pay on time. When clients know there’s a consequence for late payment, they’re more likely to adhere to the payment schedule.

It helps you get paid on time because clients are motivated to avoid extra charges. Late payment fees act as a deterrent to delay.

Specify the late payment fee in your payment terms. Be fair and transparent about this fee; most clients will strive to pay on time to avoid it.

RELATED ARTICLE: Unpaid Invoices: A Simple Guide for Freelancers & SMEs

Tip 8: Maintain Positive Client Relationships

Maintaining positive client relationships is vital for getting paid on time. Good relationships build trust. Clients are more likely to prioritize payments when they value your partnership.

It helps you get paid on time because clients will respect your business and payment expectations. For example, if a company gives really good customer service, 75% of customers will forgive a mistake. But if the service is bad, only 14% will.

Always provide excellent customer service, communicate clearly, and be responsive to client inquiries. Building trust and rapport can lead to prompt payments and long-lasting business relationships.

Take Action Today

For faster payments, try these simple steps:

1. Research Invoicing Software Options

Spend some time today exploring different invoicing software options.

Look for features that suit your specific business needs. Pay attention to user reviews and consider trying out free trials.

2. Review Your Payment Terms

Take a moment to review your current payment terms. Are they clearly communicated on your invoices?

Consider adjusting the payment window (e.g., from 30 days to 15 days) or offering incentives for early payments.

Make sure these terms are visible and understood in every transaction.

3. Draft a Payment Reminder Template

Create a polite yet firm payment reminder template. This should include a reference to the original invoice, the due date, and a request for payment status.

Ensure it’s courteous and maintains a positive tone to preserve client relationships. This template can be customized for future use.