How to Keep Track of Invoices & Payments: A Comprehensive Guide

August 19, 2023

Among many crucial business practices, learning how to keep track of invoices and payments emerges as mission critical. Recent statistics reveal that 11% of customers never receive their invoices, with 35% of unpaid invoices remaining for over 30 days. These numbers underscore the importance of invoice monitoring, as it safeguards revenue streams and fosters financial stability and growth, making it essential for any thriving business.

Implementing a Centralized Tracking System

Utilizing a centralized invoice tracking system and maintaining organizational efficiency is paramount in business. It streamlines invoice and payment management by consolidating financial data, saving time, and reducing errors. With everything organized, companies can track invoices and their status, identify outstanding fees, and collect payments promptly.

Quick access to comprehensive financial information empowers informed decisions, optimizing cash flow and resource allocation. A well-organized system fosters transparency, accountability, and more robust client and supplier relationships. This results in improved financial control, heightened productivity, and a competitive advantage in today’s fast-paced business landscape.

Spreadsheets vs. Billing Software

The differences between using spreadsheets and all-inclusive billing software are significant. Spreadsheets lack automation and real-time synchronization, leading to errors and inefficiencies in managing invoices and payments. In contrast, all-inclusive billing and payment tracking software offer automated invoicing and integrated payment gateways, ensuring accuracy and streamlined workflows.

With real-time updates and centralized data, businesses can enhance financial control, reduce errors, and expedite payment collections. Opting for all-inclusive billing software leads to increased productivity, improved financial management, and higher customer satisfaction, making it the superior choice for optimizing invoicing and payment processes.

What Details Are Important to Track?

Maintaining a comprehensive tracking system for payment and invoice details enhances fiscal management, improves cash flow, and fosters stronger customer relationships. To efficiently manage invoices and payments, consider the following vital elements:

- Invoice Date: The date when the invoice was issued to the customer

- Invoice Received Confirmation: Keeping track of whether the customer has received the invoice is essential to ensure prompt payment and avoid any miscommunication

- Payment Date: The date when the customer paid

- Payment Due Date: The date the payment is due from the customer

- Method of Payment: Recording the payment method used by the customer, such as credit card transactions, bank transfers, or cash

- Payment Status: Tracking whether the payment is pending, received, or overdue helps monitor the overall payment process

- Invoice Number: Assigning a unique number to each invoice aids in easy identification and reference

- Customer Information: Maintaining details about the customer, such as name, contact information, and billing address, helps streamline communication and ensures accurate invoicing

- Line Items & Descriptions: Including a breakdown of goods or services provided with their corresponding prices helps clarify the invoice and reduces payment disputes

- Tax Information: Accurate recording of taxes applied to the invoice amount ensures compliance with tax regulations and helps with financial reporting

- Late Payment Penalties & Discounts: Tracking late fees and/or offering discounts encourages customers to pay on time

- Payment Receipts: Keeping track of payment receipts issued to customers provides proof of payment for both parties

- Aging Reports: Generating aging reports allows businesses to promptly identify and address overdue payments

- Reconciliation: Regularly reconciling invoices and payments with accounting records ensures accurate financial reporting and detects any discrepancies

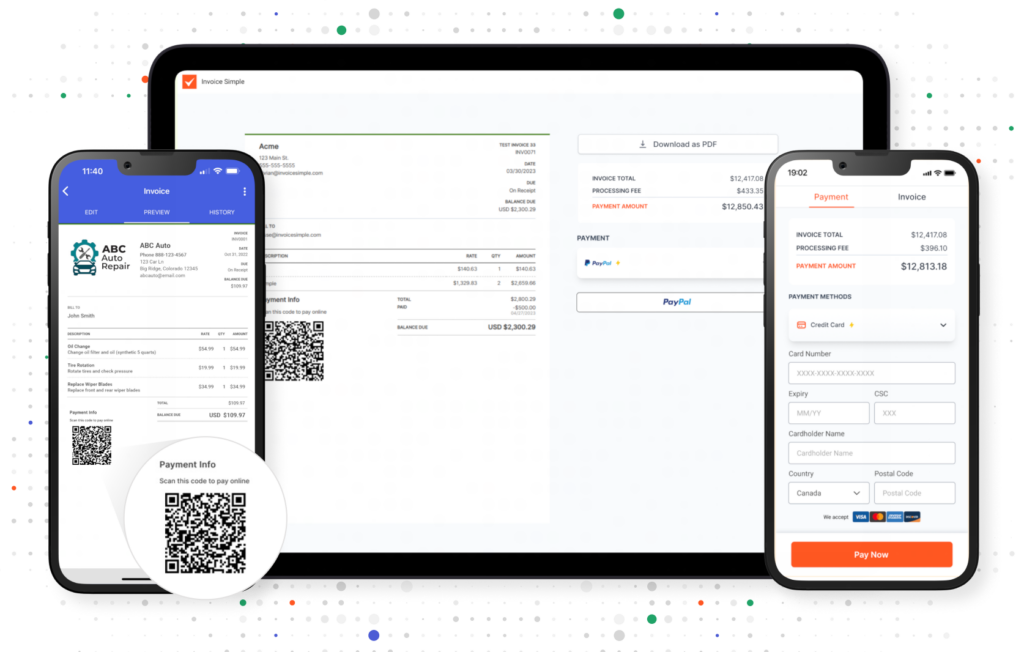

Need a better way to track your invoices & payments? Invoice Simple can help.

Setting Up an Invoice & Payment System

Establishing an efficient invoice and payment system is crucial for businesses that want to enhance their financial operations. While the initial setup requires effort, the long-term benefits make it a worthwhile investment. A well-designed system streamlines billing, ensuring prompt invoicing and seamless payment transactions.

As teams familiarize themselves with the user-friendly design, navigation becomes simpler, empowering them to focus on essential tasks instead of laborious manual billing. Implementing an organized invoice management system elevates the billing process, fostering improved financial control and overall efficiency in day-to-day business operations.

Choosing the Right Invoicing & Payment Software or Tool

When choosing a payment and invoicing software, it’s essential to consider various features to ensure it meets the specific needs of your business. Here are some key aspects to look for:

- User-friendly interface

- Customizable templates

- Automated invoicing

- Recurring invoices

- Payment gateway integration

- Multiple payment options

- Overdue payment reminders

- Expense tracking

- Reporting and analytics

- Multi-currency support

- Mobile accessibility, like mobile payments

- Security measures

- Customer support

Customizing Invoice Templates for Your Business

Tailoring invoice templates to your needs is crucial as it enables you to present a professional image and strengthen your brand identity with every interaction. Personalized templates reflect your company’s image, fostering client credibility and trust. Utilizing specialized software to generate invoices streamlines the process, ensuring consistency and saving valuable time.

With software, you can effortlessly add your logo, tailor layouts, and include essential details, creating polished and branded invoices that leave a lasting impression on customers. The ability to customize templates not only enhances the professionalism of your invoicing process but also sets the stage for better customer relations and long-term success.

Need a better way to get paid? Invoice Simple can help.

Things to Know About Reminders and Follow-Ups

In payment management, sending reminders before the due date is essential in maintaining smooth cash flow and encouraging prompt client payments.

Sending Payment Reminders Before the Due Date

Prompt communication with clients a few days before the payment deadline fosters positive client relationships and encourages timely payments. Use a polite, professional tone and multiple communication channels for timely outreach. Including essential information, offering assistance, and automating reminders further enhance the efficiency of the payment process and foster financial stability for businesses.

How to Follow Up on Past-Due Invoices

Companies can effectively handle outstanding invoices with these tried and tested tips:

- Prompt Communication: Send a follow-up email once the payment becomes overdue, ensuring everything is in one place. Be direct and clear about the owed amount and due date and offer help if needed (like a payment plan).

- Creativity with Subject Lines: Grab attention with clear and attention-grabbing subject lines, such as “Invoice #12345 — Payment Overdue” or “Urgent: Invoice #12345 Past Due.”

- Tailor Your Approach: Customize your email based on the invoice’s age and the client’s payment history. Use a recent due date email template for general follow-ups, an overdue payment template for significant delays, and a final-notice template as a last resort for unresponsive clients.

Dealing with Late Payments

Businesses can further streamline their invoicing process and effectively address overdue payments by implementing these procedures:

- Set Clear Payment Terms: Establish clear and concise payment terms from the beginning of your business relationship with clients. Ensure that they know the due date and any delinquent payment penalties or fees. Having transparent terms can help prevent past-due payments and set expectations.

- Implement Automated Reminders: Utilize automated reminder systems to send regular payment reminders to clients as the due date approaches. This proactive approach reduces the chances of invoices slipping through the cracks and encourages timely payments.

Reconciliation and Reporting

Discrepancies and errors can arise as invoices are issued and payments are received, leading to financial mismanagement. Reconciliation involves matching transactions and accounts, identifying differences, and rectifying inconsistencies. This process helps to safeguard against inaccuracies. Detailed reporting allows businesses to gain valuable insights into their cash flow, outstanding payments, and revenue trends.

How to Reconcile Invoices and Payments

Here are a few essential tips to effectively reconcile billing and transactions:

- Organize Documentation: Maintain a well-organized system for storing all invoices and payment records. Physical files or digital folders should categorize invoices based on clients, dates, or payment methods. Having easy access to relevant documents simplifies the reconciliation process.

- Regularly Compare Records: Periodically compare your invoices with the corresponding payments received. Cross-reference the invoice, amounts, and payment dates to identify discrepancies, as this will help you spot missing payments, overpayments, or outstanding balances.

- Utilize Accounting Software: Invest in reliable accounting software with reconciliation features. Automated reconciliation tools can streamline the process by automatically matching invoices with payments, saving time and reducing human errors.

Generating Reports & Identifying Trends

Reconciling and tracking payments and invoices is the best way to lay the groundwork for accurate financial reports, offering valuable insights into a business’s economic performance. Companies gain a comprehensive overview of cash flow, outstanding receivables, and revenue trends by meticulously matching invoices with costs.

These reports aid strategic decision making, highlight improvement opportunities, and simplify tax calculations during tax season. Generating such reports fosters financial transparency, empowering business owners to navigate market changes and confidently thrive in an ever-evolving landscape.

Storing and Backing Up Data

Data preservation is paramount in today’s digital age, especially when using cloud-based software. A reliable backup system ensures protection against data loss, accidental deletions, or potential cyber threats, providing businesses with peace of mind and the ability to swiftly recover and continue operations in case of unforeseen events.

Choosing a Secure Storage Method for Financial Records

While many databases, like Invoice Simple, offer encryption and security features, alternative ways of securely storing backups are equally vital, especially for businesses not using invoicing/payment software. Implementing offline storage solutions such as external hard drives, encrypted USBs, or secure offline servers can protect data.

Utilizing cloud-based software backup services with robust encryption protocols and multi-factor authentication ensures redundancy and data integrity. Complementing these storage options with strict access controls, regular data audits, and off-site storage for disaster recovery further enhances the security of financial records, assuring businesses of the utmost confidentiality and resilience against potential threats.

Implementing Regular Data Backups

A good strategy is fundamental for safeguarding business information and ensuring continuity. Consider setting a consistent backup cadence based on data frequency and importance. Retaining multiple versions allows recovery from various points in time while managing storage efficiently requires determining appropriate retention periods.

Regularly testing the restoration process ensures invoice data integrity and system reliability. With a well-planned backup strategy, businesses can confidently protect their data and respond swiftly to data loss incidents.

Tips & Best Practices to Streamline Your Billing Process

The invoicing and payment process can sometimes become clunky and inefficient, leading to potential delays and errors. By implementing these tips and best practices, businesses can streamline their billing process, ensuring smoother and more efficient operations.

Integrating Invoicing with Accounting

Syncing invoicing data with an accounting software system makes generating financial reports seamless and accurate. This integration ensures that all financial transactions, including invoices and payments, are automatically recorded, eliminating the need for manual data entry and reducing the risk of errors.

Collaboration with accountants becomes more efficient, as they can access up-to-date financial information, enabling them to provide valuable insights, perform precise analyses, and facilitate smoother tax preparation and financial reporting processes. With a well-integrated invoicing and accounting software system, businesses can enjoy better monetary management, save time, and strengthen their financial decision-making capabilities.

Using Online Payment Systems for Faster Transactions

An easy-to-use online payment portal that seamlessly integrates with your invoices simplifies the payment experience for clients. With just a few clicks, customers can make secure and immediate payments, eliminating the need to process payments manually or mail checks, accelerating cash flow and reducing the chances of payment delays. Clients can conveniently settle their invoices from anywhere and at any time.

Integrating online payments with invoices provides real-time payment tracking, ensuring businesses have up-to-date information on their receivables. Companies can improve their cash flow, increase client convenience, and foster stronger customer relationships by offering a user-friendly and efficient online payment solution.

Implement Automated Reminders

Staff can set up automated reminders for pending charges sent a few days before the due date and again if the payment becomes overdue. Scheduled notifications save time and encourage timely payments, reducing the need for manual follow-ups and improving cash flow.

Offer Multiple Payment Options

Provide clients with various payment options offered through payment service providers to cater to their preferences. Alongside traditional methods like credit cards and bank transfers, consider incorporating digital wallets and online payment platforms. Offering diverse payment options makes it easier for clients to make payments efficiently, boosting overall satisfaction.

Stay Organized and Consistent with Record Keeping

Regularly updating and organizing financial data, like invoices, payment receipts, and expense reports, helps businesses avoid errors and financial discrepancies. By staying current with record keeping, companies can track transactions, monitor cash flow, and make informed financial decisions. Organized records also streamline tax preparation, audits, and financial reporting, saving time and resources while contributing to the business’s financial stability.

Continuously Evaluate and Improve Your Invoicing Process

Internally, regular assessments help identify inefficiencies and bottlenecks, enabling businesses to streamline operations, enhance productivity, and reduce errors. Companies can optimize their invoicing workflows by adapting to best practices and adopting innovative technologies, saving time and resources.

Externally, an efficient invoicing process fosters positive customer experiences. Timely and accurate invoicing cultivates trust and professionalism, promoting prompt payments and building stronger client relationships. Embracing a culture of constant improvement ensures that the invoicing process remains adaptable to evolving needs and market demands, leading to a solid future financial strategy.